Frs retirement calculator

After login click Create. The total amount of CPF savings all owners are allowed to use for your property is capped at a percentage of the lower of the purchase price or the.

Retirement Calculator Spreadsheet Retirement Calculator Budget Template Simple Budget Template

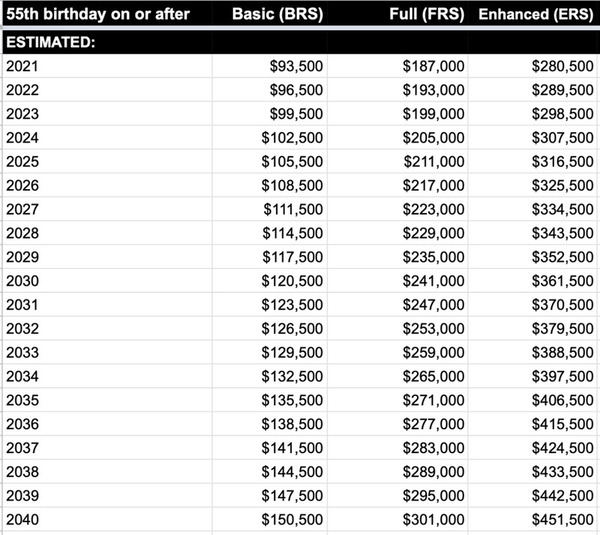

Year If you turn 55 in this year Full Retirement Sum.

. The closest thing you can get is the CPF LIFE Estimator which only allows seniors aged above 55 to use. If you are an employee of a non-profit tax-exempt organization a 403b can be one of your best tools for creating a secure retirement. Ok so if Im.

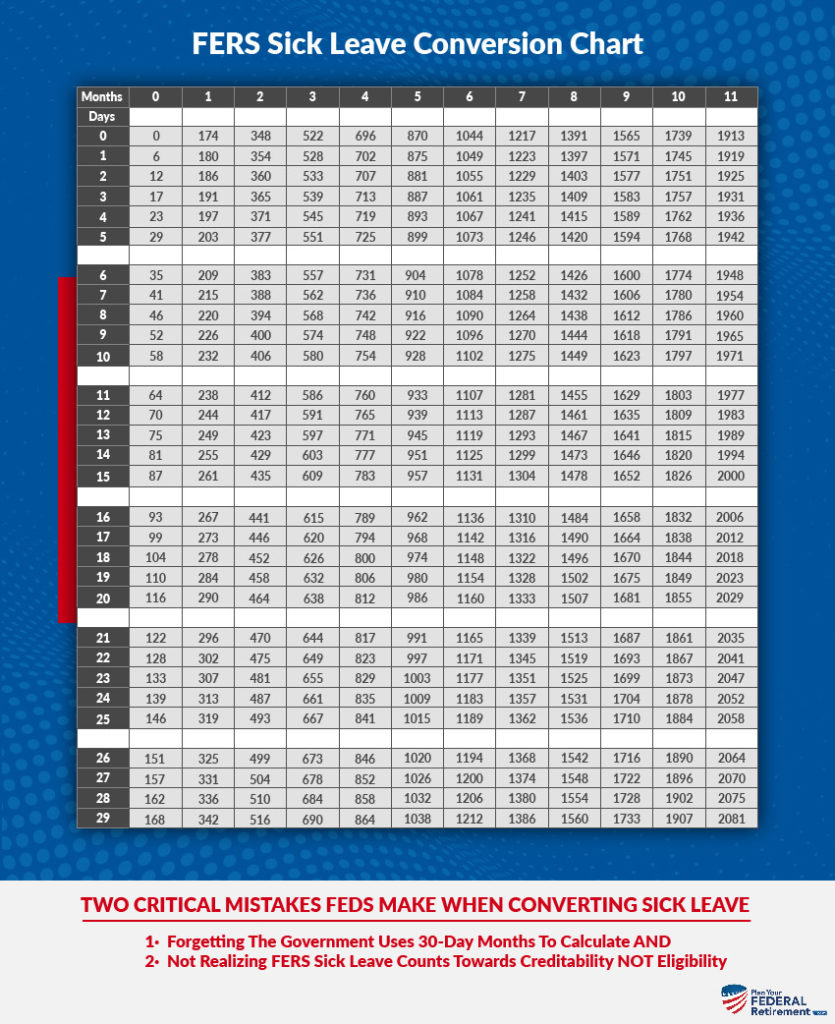

HR-3007 Sick Leave Pool. Subsequently the estimated monthly payouts youll receive for those turning 55 in 2022 for BRS FRS and ERS are S850 S1570 and S2300 respectively. A 500 spouses benefit would be reduced to The spouses benefit is reduced by 5.

Advance Ruling System for Income Tax. If you terminated FRS-covered employment before July 1 2001 the vesting period varied. Full Retirement Sum FRS The FRS is the standard maximum amount that will be transferred from your CPF OA and SA.

For over 30-years Joe Carreno of The Retirement Advantage has been a Federal Employee Retirement System specialist FERS as well as a Florida Retirement System specialist FRS independent advocate. HR-3010 Temporary Total Disability Benefits Payments. CPF LIFE will then provide you with monthly payouts.

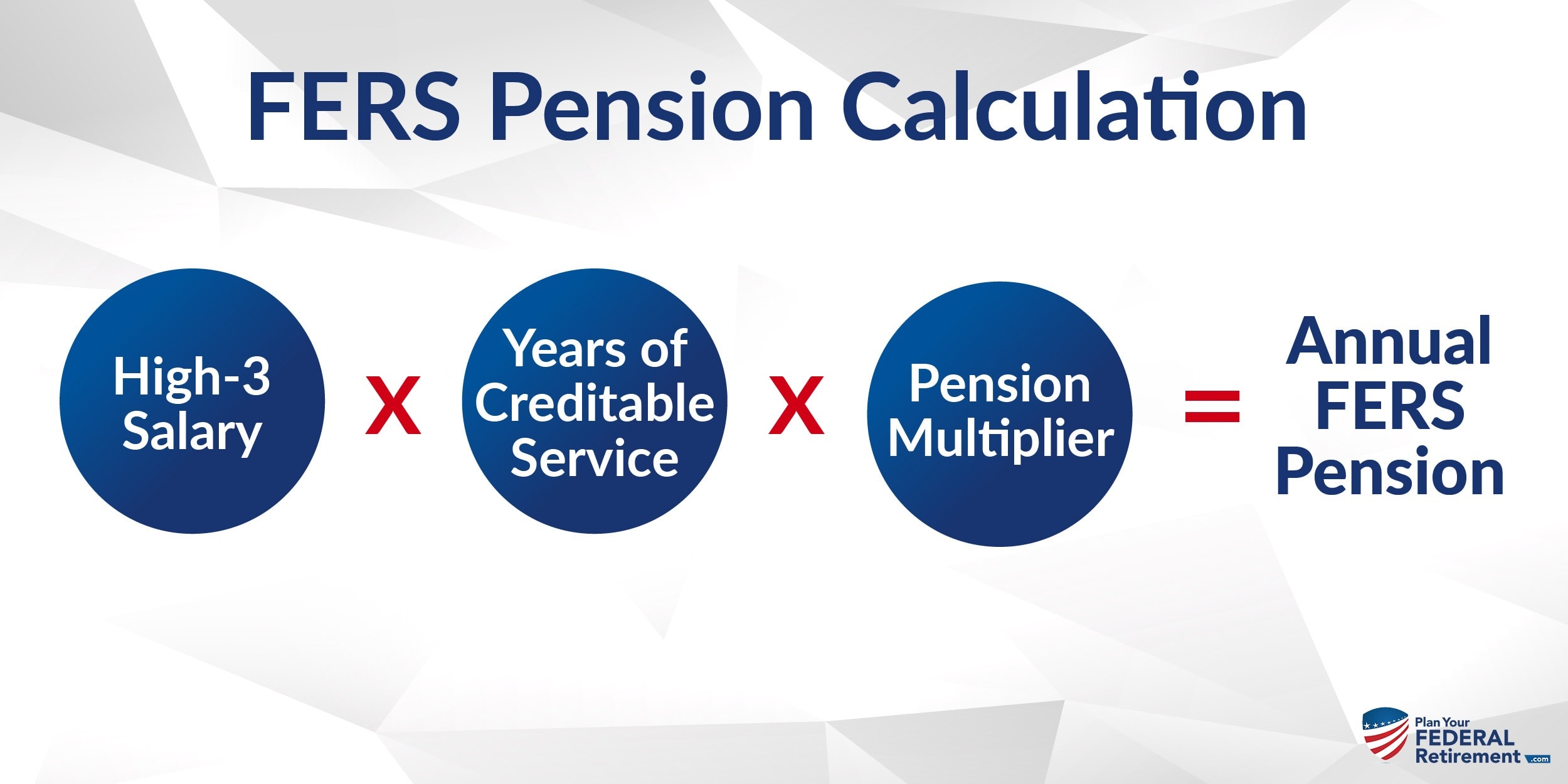

FIU 403b Plan Document. Have 33 years of service regardless of your age at retirement. Adopting Financial Reporting Standard FRS 109.

There are also assumptions made with regards to CPF policies and interest rates remaining the same. If you are below age 55 the FRS applicable to you is the current FRS. Unfortunately there isnt an accessible CPF LIFE Calculator.

CPF Full Retirement Sum FRS The FRS is double the BRS. You can use the CPF LIFE payout estimator calculator to gauge how much lesser youll be receiving if you pledge your property and withdraw more of your CPF in cash. The FRS also oversees the retirement plans for state university and community colleges and for.

Social Security is calculated on a sliding scale based on your income. Maximizing your contributions now will allow more time to save money for your future retirement. You can withdraw all of the money and close the product early for a fee of 90 days interest.

FRS Online Services benefit calculator service history etc Division of Retirement DOR Calculations. HR-3006 Parental Leave of Absence. If youre not sure how to go about deciding how much to set.

A 1000 retirement benefit would be reduced to The retirement benefit is reduced by 4. View your retirement savings balance and your withdrawals for each year until the end of your retirement. HR-3009 Abscences for Religious Holidays.

To get a customized estimate of benefits please login to FRS Online. If you enrolled in the FRS on or after July 1 2011 you must have 8 years of service to vest. However you must have at least 60000 in your CPF Retirement Account.

A pension plan for long-term workers and a defined contribution plan for shorter-service workers or people who do not plan on working for the state for more than six years. An affiliate of PSRE Public Sector Retirement Educators a Federal Contractor Registered Vendor to the Federal Government also an affiliate. If you are at least age 65.

Hired Before July 2011. At Age 62 3. Mr Mitchell was a key member of Cochlears executive team responsible for the setting and execution of the companys growth strategy from its listing in 1995 until his retirement in 2017.

Productivity. Use the CPF Retirement Sum calculator. To see how your water usage stacks up please visit SWFWMD Water Use Calculator.

The IRS sets limits on the amount of money that can be contributed to your voluntary retirement plans. Mr Mitchell currently holds non-executive director roles with ASX-listed healthcare companies Fisher and Paykel Healthcare Corporation Limited from November. Here are the most recent FRS sums.

HR-3011 Processing Invoices for Independent Medicals Exams. Oath of Loyalty Off Cycle Request Form Offer Letter - USPS AP and EG Positions Offer Letter - USPS AP Positions Auxiliary Funds CG Title III and Local Funds OPS Personnel Action Request HR form HR-451 revised 1218 OPS StaffStudent Time Sheet Outside Employment Form. 403b.

The Endowus CPF calculator is reliant on the accuracy of CPF members inputs and assumptions made on investment returns CPF Full Retirement Sum FRS and Basic Healthcare Sum BHS growth rates for it to give a robust projection. Use this calculator to see why this is a retirement savings plan you cannot afford to pass up. Enhanced Retirement Sum ERS or BRS x 3.

Including a non-working spouse in your plan increases your Social Security benefits up to but not over the. 1-844-377-1888 MyFRS financial planners. My Retirement Manager Retirement Manager.

Savings in your Retirement Account if you are above 55 Special Account and OA can be used to meet your FRS requirement. The Florida Retirement System FRS offers two retirement plans for state employees. If you enrolled in the FRS prior to July 1 2011 you need to have 6 years of service with an FRS employer to be vested in your Pension Plan benefit.

Future changes in salary and other factors will affect the amounts shown. As a teacher you can qualify if you. This means that when your CPF RA is created your CPF SA and OA savings will be transferred there up to the FRS.

You cant close the product or withdraw any money until the end of your fixed rate period. LoansHardships Withdrawals requests are processed through My Retirement Manager. Nine 9 over Twelve 12 Pay Option Calculator.

As mentioned at age 55 your SA and OA in that order up to the FRS will be transferred into the RA and thatll be your retirement sum to enter into CPF LIFE at age 65-70. Here is a good resource from the FRS directly. Bureau of Deferred Compensation.

66 and 2 months. Interbank Offered Rate Reform. With the FRS Pension Plan normal retirement age is set at age 65 with a minimum of eight years of service.

The CPF retirement sums are adjusted each year to keep up with inflation. Tax Treatment of Interest Gains or Profits Derived from Negotiable Certificates of Deposit by Non-Financial. The 403b Savings Plan andor 457 Deferred Compensation plans.

Basic Retirement Sum BRS Full Retirement Sum FRS or BRS x 2. The University of South Florida offers all employees Administration Faculty Staff and Temporary the opportunity to participate in two 2 tax-deferred programs. A 457 plan can be one of your best tools for creating a secure retirement.

Tuesday Friday 700 am 500 pm. HR-3004 Recording Overtime on Attendance and Leave Report. This statement and calculations of your estimated retirement benefit are based on unverified data and are only approximations of the amount you would receive upon retiring.

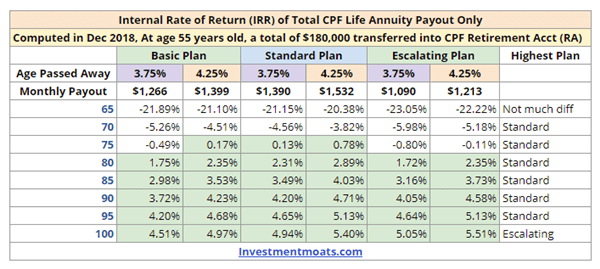

To illustrate CPF members who turn 55 in 2019 will receive between 1350 1450 in monthly payouts for life if they set aside the Full Retirement Sum and are on the Standard Plan. For example if youre turning 55 years old in 2022 the BRS is S96000 FRS is S192000 and ERS is S288000. Deposits of 50000 or over.

Full normal Retirement Age Months between age 62 and full retirement age 2. Singaporeans born in 1958 and later will be automatically placed on the CPF Life scheme. HR-3008 Leave of Absence.

CPF retirement sum vs CPF Life. Use this calculator to help you create your retirement plan.

The Surprisingly Simple Math To Retiring On Real Estate Retirement Calculator Savings Calculator Retirement Savings Calculator

Buying Back Military Time The Ultimate Guide Haws Federal Advisors

Fers Retirement And Sick Leave Plan Your Federal Retirement

How Endowus Cpf Calculator Can Help Determine The Amount We Need To Achieve Our Retirement Goals

Mentalmente Zapatos Armonia State Retirement Pension Calculator Livehappilyeverhealthy Com

Which Cpf Life Plan Gives The Greatest Return Investment Moats

Fers Retirement Calculator 6 Simple Steps To Estimate Your Federal Pension Retirement Calculator Federal Retirement Retirement

Calculators Ipers

Understanding Your Fers Retirement Plan Your Federal Retirement

2

My Retirement Plan Part 1 Cpf A Retirement Funds Calculator

Calculating Service Credit For Sick Leave At Retirement

Florida Retirement System Pension Info Taxes Financial Health

Cpf Life Or Retirement Sum Scheme Just2me

2

Benefits Fiu Human Resources

Plan Your Retirement Calculate Your Cpf Full Retirement Sum Frs When You Turn 55 Investingtoolkits Com